Customer Service Charter

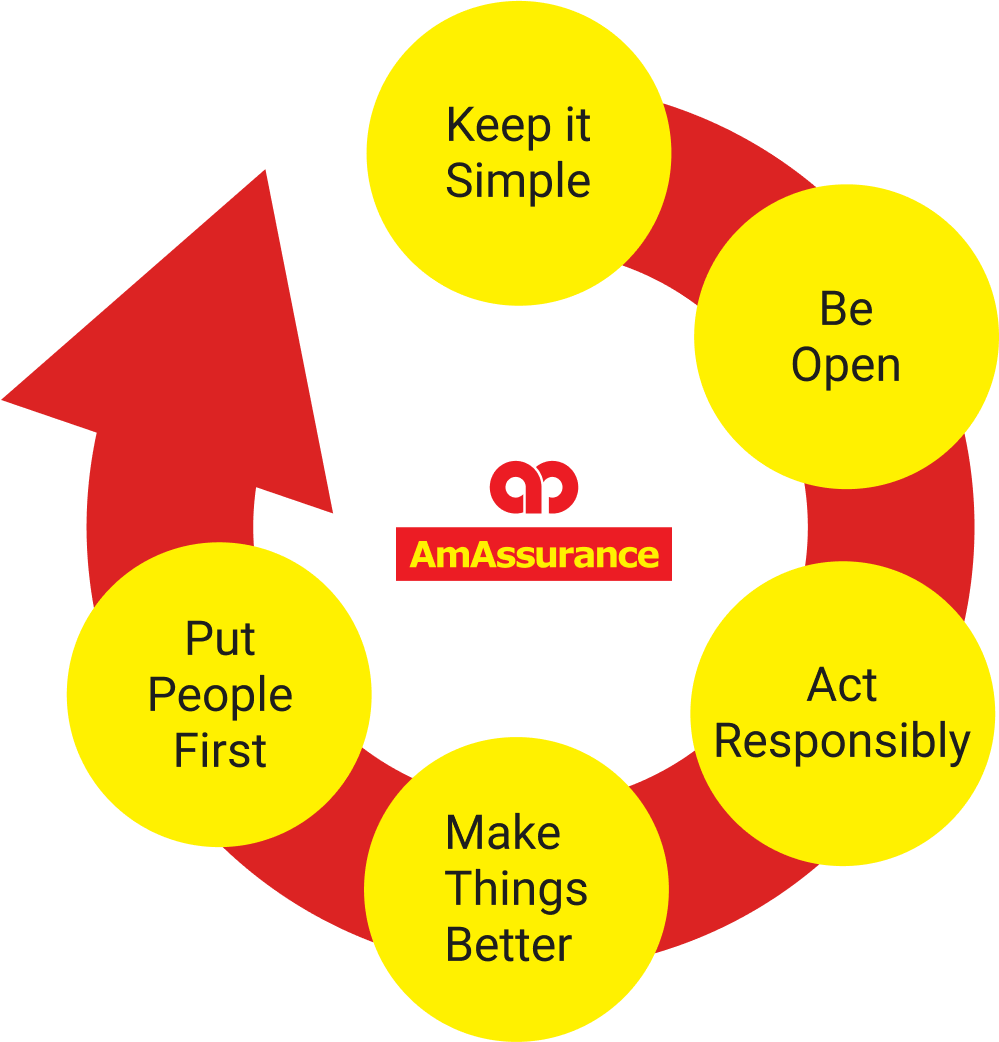

Liberty General Insurance Berhad is committed in pursuit of delivering an exceptional service experience to our internal and external customers in tandem with our values as below:

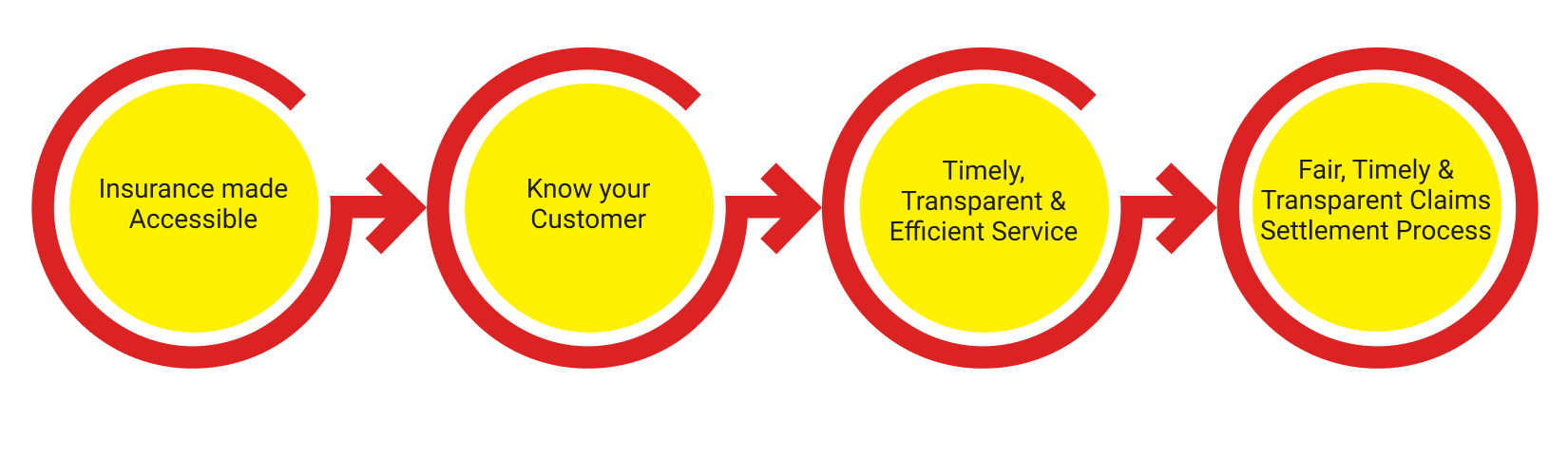

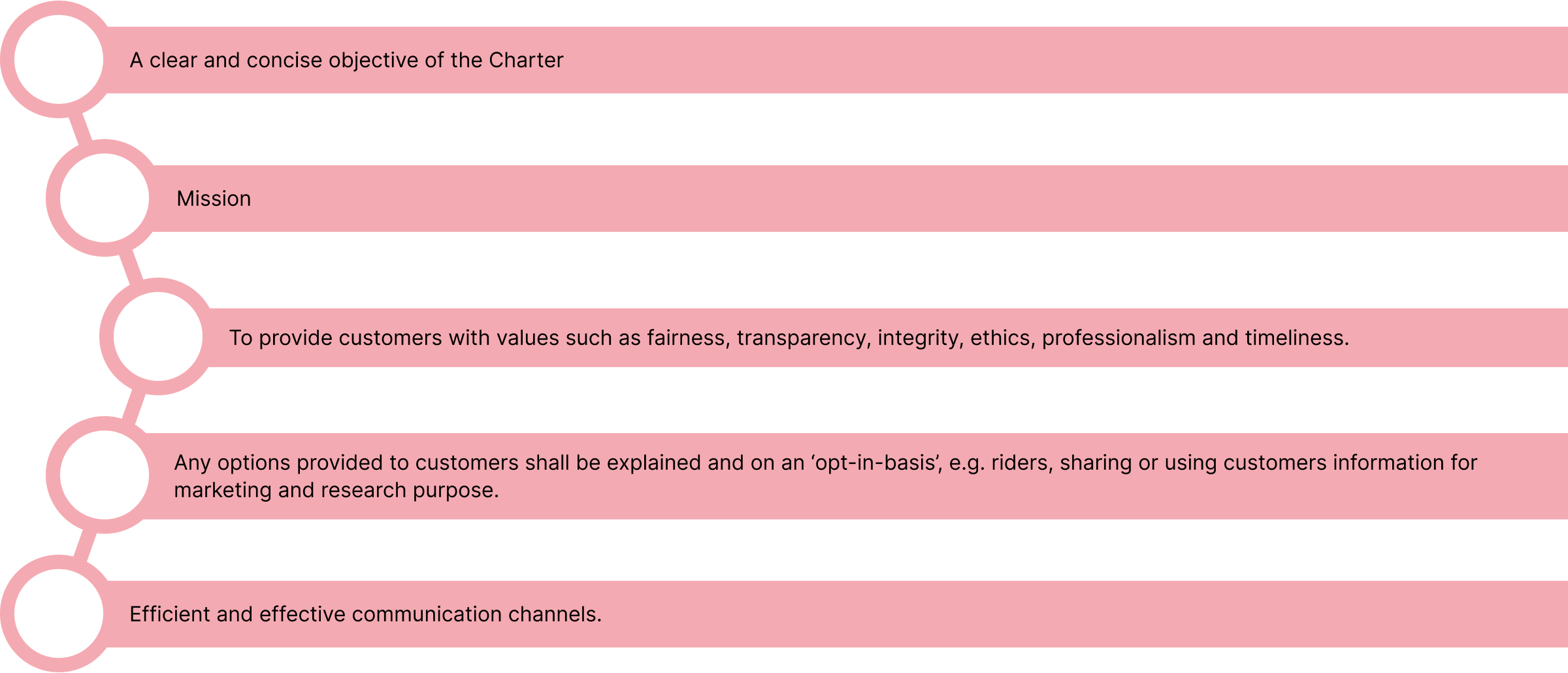

We are aligned and supportive with initiative by Bank Negara Malaysia along with PIAM, LIAM and MTA, that formalized the industry’s Customer Service Charter especially for the Malaysian Insurance and Takaful industry at large through 4 key pillars, namely:

-

Better Engagement & Improved Services

Our Commitment

We will make insurance products easily accessible via various channels, physically and virtually, to obtain information, purchase or make enquiries.

Our Service Level

We offer an active engagement model wherein a customer is aware of:

Multi-channel options and accessibility for making purchases and enquiries.

Where and how to provide feedback, suggestions and complaints. Reinforce that insurance is easily accessible via various channels, physically and virtually.

Customers are kept informed on the physical and engagement channels available for them to purchase products or to make enquiries.

Customers have access to the following: - An insurance agent locator.

- List of customer engagement channels, i.e. corporate website, self-service portal and contact centre.

Note: Channel availability may vary from time to time, and customers will be informed accordingly. Customers are provided with available channels to provide feedback and suggestions via:

Emergency Roadside Assistance Hotline: 1 800 88 3833

Customer Service Hotline: 1 800 88 6333

Letter

Liberty Insurance Tower,

CT9, Pavilion Damansara Heights,

3, Jalan Damanlela,

Pusat Bandar Damansara,

50490 Kuala Lumpur

Corporate Website and Self Service Portal

www.amassurance.com.my

Branch Locator

https://www.amassurance.com.my/locateNote: The Insurer will conduct periodic customer satisfaction feedback/surveys to ensure that customers’ needs are fulfilled.

-

Build Trust

Our Commitment

We will strive to help customers find the right product to suit their needs.

Our Service Level

Knowledgeable and ethical staff, agents and partners are available to serve customers.

Training - Ensure employees and intermediaries are properly trained on products and services offered.

- Training must be provided any time a new product is launched and regular refresher courses are provided on existing products.

Understanding Customer Needs

In order to understand customers’ needs adequately, staff, agents and partners shall ensure they:- Listen attentively to the customers.

- Acknowledge and properly understand the customers’ needs and preferences.

- Ask for requisite information and documents to assist customers in accordance with the Industry’s Code of Practice on Personal Data Protection Act 2010.

- Offer options on suitable products and services that meet our customers’ needs.

Any additional product and service options provided to customers shall be made clear and on an "opt-in-basis", e.g. riders, sharing or using customer information for marketing and research purposes. Note: Handling of customer information is governed by Bank Negara Malaysia’s Policy Document on Management of Customer Information and Permitted Disclosures and insurers / takaful operators shall operate accordingly.

-

Customer Satisfaction

Our Commitment

We will set clear responsibilities towards customers and uphold it.

Our Service Level

A Standard commitment in ensuring the following guiding principles:

We will set clear expectation on time taken for various services

Delivery of Services

Information on turnaround time on delivery of services must be made available in the Client Charter through various channels (head offices / branches / brochures / call center / website)

Standard to be adopted: - Serve walk-in customers promptly

- Customer waiting time: within 10 minutes

Customers shall be informed of each step and documentation required to amend, renew, surrender or cancel a policy, e.g. what happens when there are changes to the policy, notice on renewal, etc. as well as consequence arising from any of these actions.

Customers are reminded in the renewal notice to inform the insurance company of any changes in the risk prior to renewal.

The standard operating procedure when dealing with customers must be clearly complied with. We will ensure efficient policy servicing and providing relevant documentation in a timely manner

Motor

- E-policy - Immediate

- Manual - 5 working days *(with the exception of new vehicles to be registered with JPJ)

Non-Motor

- Within 10 working days *(applicable for individuals only, not applicable to group)

Change of Policy Details, Reissuance Upon Lapse or Endorsement (upon acceptance in the policy system)

- Motor - within 3 working days

- Non-Motor - within 5 working days

Renewal Notice Issuance

- 30 calendar days before expiry of existing policy

Cancellation or Surrendering of Policy (including refund of premium)

- Motor - within 5 working days

- Non-Motor - within 7 working days

We will be open and transparent in our dealings

The following information shall be easily accessible and made available through the various channels of communication such as branches, brochures, call center and website:

Product related details, i.e. product features, product disclosure sheets, terms and conditions, key facts and exclusions will be shared at the point of sale.

Fees, charges (other than premiums), and interest (if any) as well as obligations in the use of a product or service (e.g. when premium needs to be paid and explaining payment before cover warranty).

Anti-fraud statement and key points to remember, i.e. confidentiality of customer information, free look period of not less than 15 calendar days (life & family takaful) & insurers / takaful operators’ right to reject or accept applications.

All the above information shall be explained and stated using simple words in an easy to understand manner We will follow through and provide the requisite answers and updates to customers queries & complaints promptly

Voice

Email

Letter

Walk In Centre

Where no follow-up is required, with a First Call Resolution

Where follow-up is required, within 3 working days from the date of the first callStandard enquiry, within 3 working days

Acknowledgment on the email received within 1 calendar day.Standard enquiry, within 3 working days

Where no follow-up is required, with a first touch point resolution

Where follow-up is required, within 5 working daysNote: Where enquiry is complex, insurers / takaful operators will provide a reasonable timeframe and keep the customer updated accordingly.

We will ensure consistent and thorough complaints handling

- Customers shall be informed of the various options for submitting a complaint through available channels.

- A verification process has to be performed on the policyholders and participants.

- Communicate clearly on the issue and gather adequate information for resolution.

- Address the issue in an equitable, objective and timely manner by keeping customers informed within within 5 or 20 working days from the date of receipt of the complaint. For complex complaint cases, it will take up to 20 working days to resolve.

- If the case is complicated or requires further investigation, we shall inform the complainant of the extended timeframe whereby a decision will be made, and a progress update will be provided every 10 working days. A final decision will be made on the complaint no later than 60 working days from the date of receipt of the complaint.

- Keep the complainant updated if unable to address issues within the stipulated timeframe.

- Refer the complainant to the next level of escalation if the resolutions are not to the satisfaction of the complainants. Contact details of BNMLINK, Bank Negara Malaysia and Financial Markets Ombudsman Service (formerly known as Ombudsman for Financial Services) must be clearly provided.

Note: Complaints handling and timelines is governed by Bank Negara Malaysia (BNM)’s Guidelines on Complaints Handling and insurers / takaful operators shall operate accordingly.

-

Provide Peace of Mind to Customers

Our Commitment

We will set clear timeline for claims settlement process and strive to settle claims within these prescribed timeline and in a transparent manner.

Our Service Level

We will set a clear timeline for the claims settlement process and strive to settle claims within the prescribed timeline and in a transparent manner.

- To set a clear timeline for the claims settlement process and strive to settle claims within the prescribed timeline and in a transparent manner by adopting the following procedures:-

-

- Customers will be informed of the estimated time taken for claims settlement process and expected service standard.

- This information shall be made available through various channels (i.e. branches, call center and website).

Please check out our Claims Service Charter for more information.

Note: Claims settlement and timeline for general insurance business is governed by Bank Negara Malaysia’s Guideline on Claims Settlement Practices and general insurers / takaful operators shall operate accordingly.

We will set a clear timeline for the claims settlement process and strive to settle claims within the prescribed timeline and in a transparent manner.

To keep the customer informed of the next level of escalation if the claims settlement or repudiation is not to his or her satisfaction.

- Customers shall be provided with available channels to appeal on a decision or raise disputes (i.e. branch, call center and website).

- Any letter of rejection or repudiation of any element of a claim and dispute on quantum which is within the purview of the Financial Markets Ombudsman Service (FMOS) must contain the following statement prominently:- Any person who is not satisfied with the decision of the Insurer or Takaful Operator, should refer to FMOS for appeal as stated in the leaflet issued by the Financial Markets Ombudsman Service (FMOS), entitle: “Resolution of Financial Disputes.”

Note: for the policy owners who made a claim/report.